PMA Set Up

PMA set up allows you to open your own business in Indonesia/Bali and to get KITAS (Temporary residency permit)

What is a PMA?

A PMA (Penanaman Modal Asing) is a type of legal entity which foreigners can choose to conduct commercial activities in Indonesia established under the Indonesia Law.

It allows you to run Business in Indonesia/ Bali and to benefit of the KITAS (Temporary residency permit).

In PT PMA, foreign investors can be registered as shareholders in the form of legal entities and individuals.

Unlike Local Company (Local PT) where the company shareholdings must consist of 100% local citizens only, with the PMA, foreigners can hold up to 100% ownership of the company in Indonesia.

However, if you aim to only represent an overseas company in Indonesia and you will not generate any income from local activities, you can set up a representative office instead.

How much do I need to invest to open a PMA?

The minimum authorized capital of the company must be at least 10 billion rupiahs written in the company documents.

But in the realization or common practice, you have to put at least 1 Billion Indonesian Rupiah (IDR 1,000,000,000) into your company business account within the first year since the company was set up.

Please note that there is no limited time to make the investment. However, it is advisable to allocate the funds in the first year from the date of the setup of the PMA to avoid any problems in case of inspections from the government.

What type of Company/ Business can I set up with a PMA?

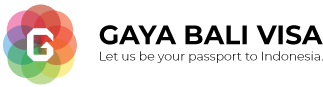

There are more than 500 business sectors in Indonesia that are classified under the KBLI.

The Indonesia Standard Industrial Classification (KBLI) is an official code system that organizes the types of business fields for companies in Indonesia.

Check our blog for the best business sectors in Bali.

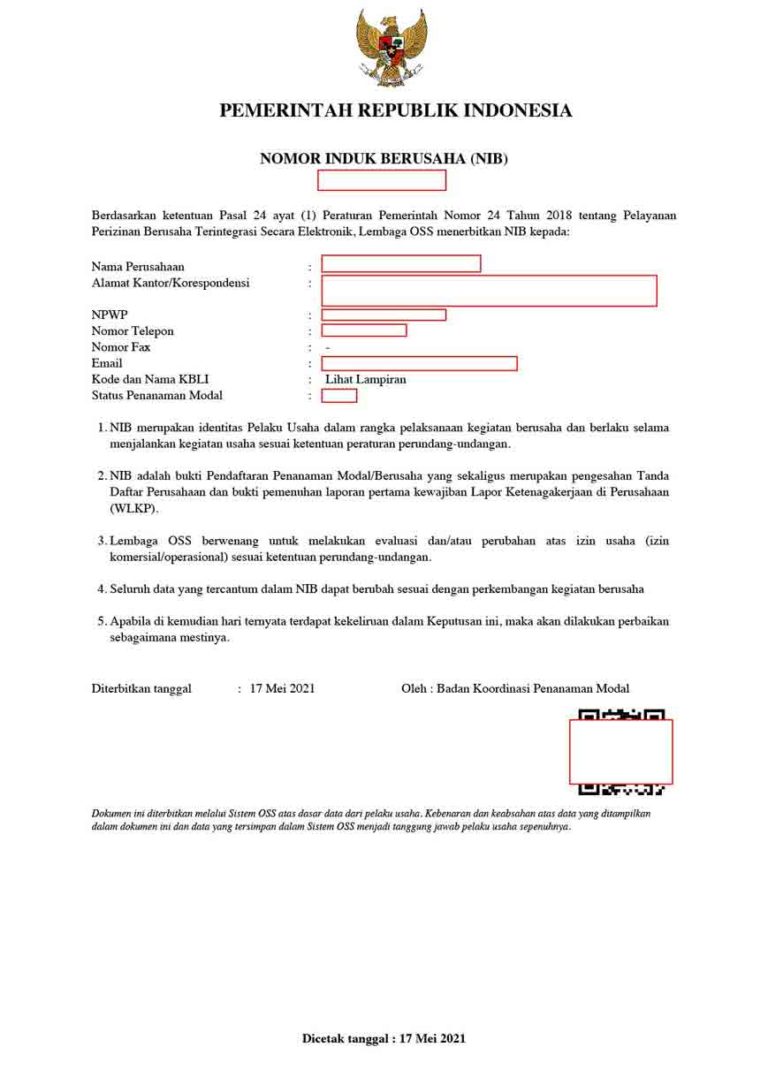

Companies wishing to register their line of business on the Deed or in the NIB must use the code according to the classification in the KBLI.

The KBLI was issued by BPS (Central Bureau of Statistics) with reference to the International Standard Classification of All Economic Activities (ISIC), ASEAN Common Industrial Classification (ACIC), and East Asia Manufacturing Statistics (EAMS).

The KBLI standardizes business activities in Indonesia into a uniform classification.

This standardization serves as a reference for legal registrations, such as in the Company Deed or NIB (Business Identification Number).

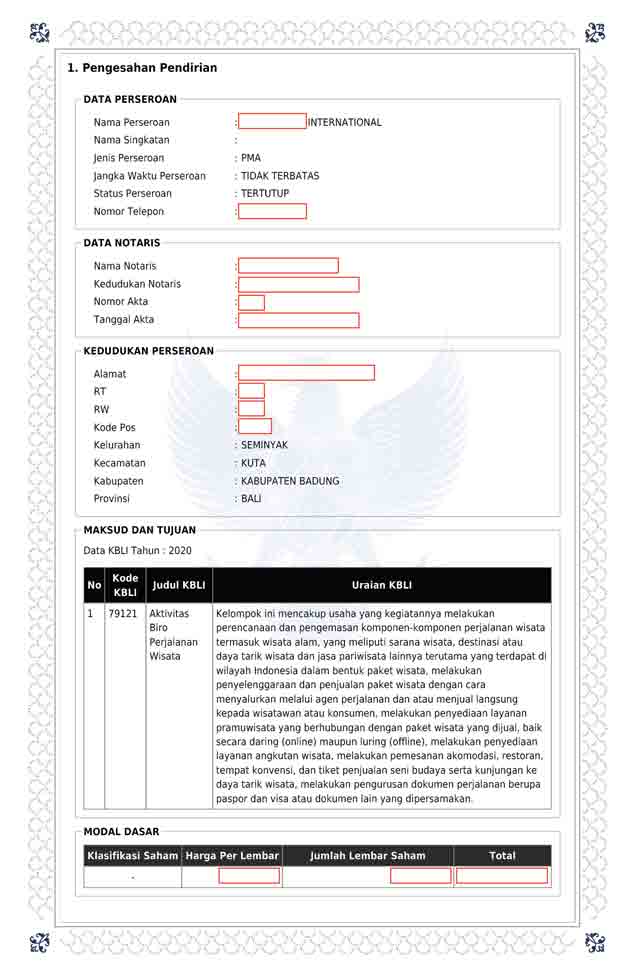

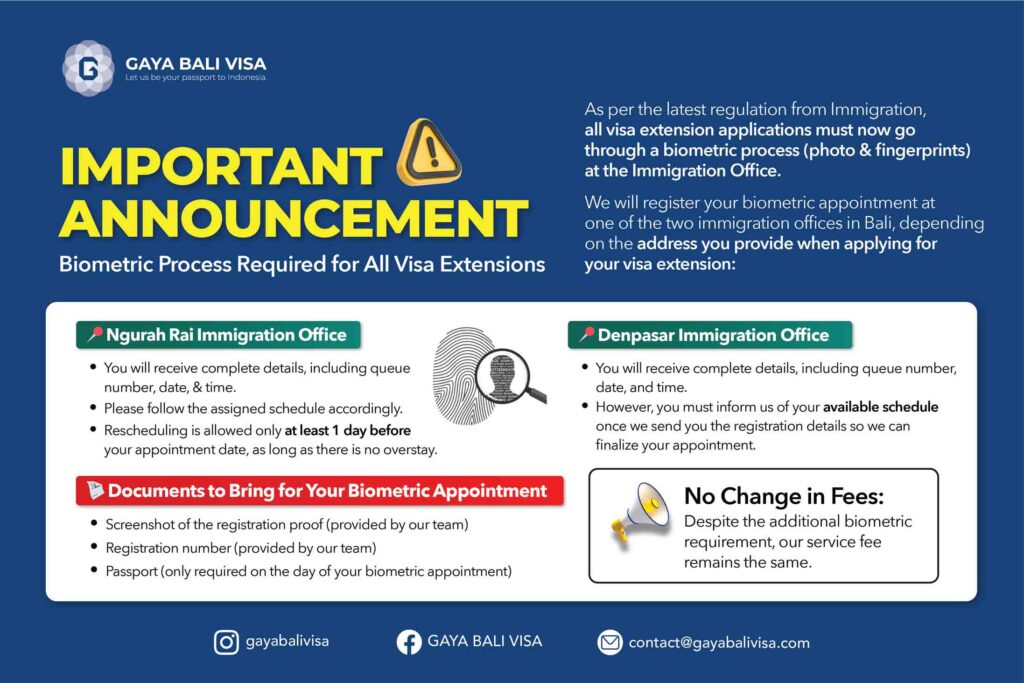

Business Identification Number (NIB)

NIB, better known as the Business Identification Number (Nomor Induk Berusaha/NIB), is a 13-digit registration number. It serves as a business owner’s identity to conduct business activities.

Every business owner must obtain an NIB before processing all the necessary licenses to legally conduct their business.

However, foreign investors are subject to the Negative Investment List in Indonesia, which specifies the maximum ownership percentage a foreigner can hold in certain business classifications.

The Negative Investment List is regularly updated by the Indonesia Investment Coordinating Board (BKPM).

Can I own Property/Land in Indonesia with PMA?

The only way for foreigners to safely invest in property or buy land in Bali is by owning an Indonesian legal entity, such as a PT or PMA.

While property owned by a PT PMA cannot be freehold, the Right to Build and Right to Use titles provide clear legal standing. These titles grant you 30 years of ownership, with the option to extend for two additional 20-year periods.

If you plan to own property, we can assist you with Legal Due Diligence to ensure all property documents are genuine, not disputed, and not fake. We also provide assistance with the notary process.

The Due Diligence service costs IDR 10,000,000 (Ten Million Indonesian Rupiah).

How long will I own the PMA for?

The validity period of a business license is stipulated to last as long as the company continues its business activities. Therefore, there are no set deadlines for the duration of your company.

How to set up a PMA?

Setting up a PMA requires a minimum of two shareholders, one Director, and one Commissioner.

The Director is responsible for the company’s operations and overall management. The Commissioner acts as the supervisor of the company and the Director but is not allowed to be involved in the company’s operations.

During the setup process, all foreign individuals do not need to be in Indonesia. We can handle the company setup while you are abroad.

What are the documents required for set up the PMA?

These are the required documents for the PMA:

You must choose a company name. This name can be in any language, without symbols, and must have a minimum of 3 words and 3 letters. Please note that terms like ‘company,’ ‘co,’ ‘community,’ ‘LTD,’ ‘Ent,’ and ‘Enterprise’ are not allowed in a PT PMA name.

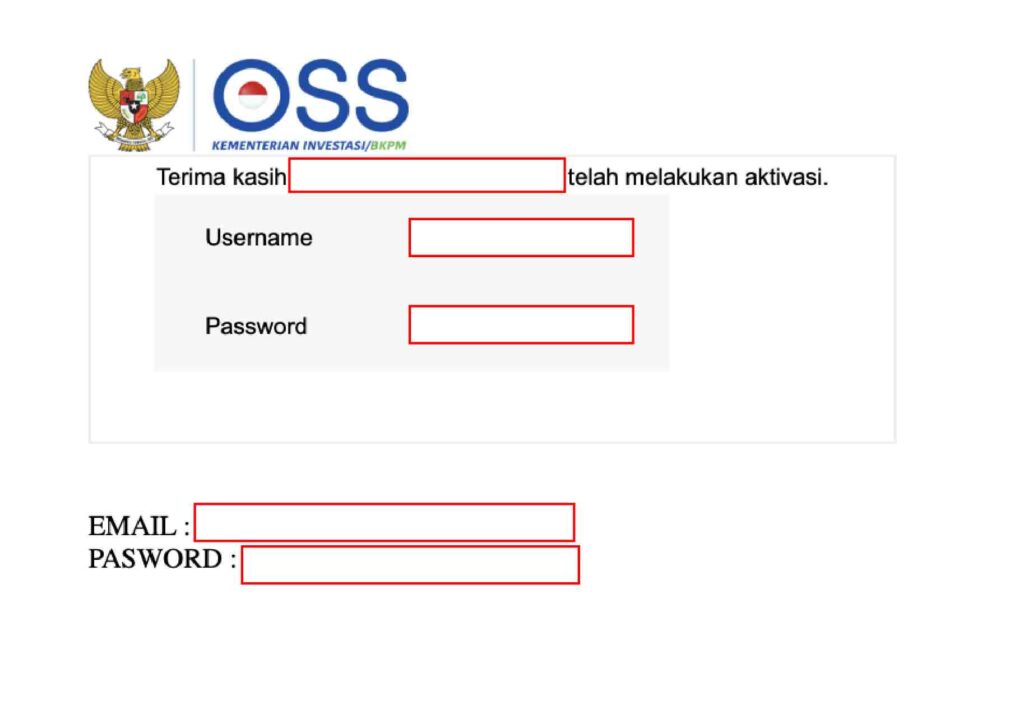

KBLI / Business Fields: Under a PT PMA, you can register up to 5 different types of business sectors. Each business field has a code in the government system called OSS. We have attached the link here: OSS.

- Positions in the company: A PT PMA requires a minimum of 2 people — 1 Director and 1 Commissioner. The minimum shareholding is 2%.

We need a passport photo or scan from all shareholders. The passport must be valid for at least 12 months for applying for the KITAS (note that a 2% shareholding does not qualify for KITAS).

PMA Tax & Report

Once your company is set up, you are obligated to report the company’s LKPM (Investment Activity Report) and income tax report.

The LKPM report is submitted quarterly, every 3 months, detailing all investments made during that period.

The tax report is submitted annually, between March and April, requiring a company bank statement covering January to December of the previous year.

If you wish to use our services, please make your request by February at the latest.

However, you are welcome to use your own tax consultant, and we will be happy to provide any necessary documents.

Tax in Details

For the first 3 years, your company tax rate is 0.5% of the total revenue, provided that your revenue is less than IDR 4.8 Billion per year.

If your revenue exceeds IDR 4.8 Billion or after 3 years, your company tax rate will be 11% of the net profit.

Our Price

Our price for setting up PMA is IDR 20,000,000 (twenty million Indonesian rupiahs)

Included in the price

- Approval of Company Name

- Deed of Establishment from Notary

- Approval of Legal Entity from The Ministry of Humanity Law and Rights of Indonesia (SK KEMENMHAM )

- Registration of Tax ID (NPWP) for company

- Virtual office address in Badung area.

- NIB and Business License registration from OSS (SPPL, PKKPR, K3L, etc.)

- Assistance with opening a company bank account

Please note that all company paperwork or documents will be only in Bahasa.

If you require translation into other languages, you can engage a sworn translator at your own expense once the PMA is set up.

Payment Methods for PMA Set Up

Our accepted payment methods are Wise, Credit Card, Revolut, and Western Union.

Please note:

- PayPal and International Bank Transfer are not accepted due to delays and high fees.

- Wise: To make your payment process faster, please use our email address as the Wise Recipient: [email protected]

- Revolut: We will begin processing once the full invoice amount is received in our bank account. Please make sure the amount of money we will receive must match the amount on the invoice, if there is a difference due to deductions or because you underpaid, you must pay the difference.

- Credit Card payments: Send us a confirmation to receive the payment link. This method incurs an additional 3% charge.

- Indonesian Company Bank Accounts: If you pay through a company bank account, especially a company from Indonesia, you will have to pay the 2% of tax on your expenses – this case only if you report the transaction.

What kind of Stay Permit KITAS can you have under PMA sponsorship?

If you hold personal shares worth a minimum of IDR 10,000,000,000 (Ten Billion Indonesian Rupiahs), you are eligible to apply for the E28A General Investment KITAS.

This KITAS is valid for 2 years and allows you to work as a Director or Commissioner in the company.

If you wish to work full-time in the company or hold specific positions, you can apply for a Working KITAS. This KITAS is valid for 1 year.

Process for PMA Set Up

Once we have received all the required documentation a letter of confirmation will be sent to your sponsor/ company

We process the KITAS recommendation from Investment Board Jakarta (BKPM Office Jakarta).

We process e-Visa Investor at General Immigration Jakarta. Estimated duration: based on the type of KITAS you are applying

Once the KITAS is finished, you will be able to enter and leave Indonesia freely, as all KITAS comes with a Multiple Exit and Re-entry Permit - MERP